The Athletes Who Went Broke

The story of the athlete who turned rags to riches by going pro is one we love to tell. Often, professional sports takes this story to the extreme with the biggest stars earning hundreds of millions. The top 100 highest-earning athletes, according to Forbes, brought in a cumulative $3.8 billion last year.

But the story of pro athletes going from riches to rags is almost as common. According to Sports Illustrated, 78 percent of former NFL players experience financial stress after just two years out of the league, and 60 percent of NBA players go broke after five years of retirement, although the NBA disputes this claim.

Athletes Who Went Broke

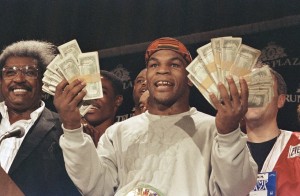

Whatever the case, though, stories of former stars falling on rough times are plentiful. There was Mike Tyson, who earned more than $400 million over the span of his career but declared bankruptcy before he retired. According to a New York Times article about his bankruptcy filing, Tyson spent lavishly. Tyson has claimed that his former promoter, Don King, cheated him out of tens of millions of dollars.

Another big name — Allen Iverson — earned more than $200 million throughout his career. Iverson has denied it, but when his wife filed for divorce in 2010, it was revealed that he was broke and spending vastly more each month than he earned. His lifetime contract with Reebok may save him though. The company pays him $800,000 a year, and he has a $32 million trust find he can access in 2030.

NFL wide receiver Terrell Owens filed for bankruptcy in 2012. Gold medal-winning figure skater Dorothy Hamill did the same in 1996. Argentinian footballer Diego Maradona allegedly owes the Italian government $50 million in taxes. Other examples of financially troubled athletes include Antoine Walker, Lenny Dykstra, Marion Jones and Boris Becker.

Why Does This Happen?

There are many reasons former professional athletes go broke. In many ways, the story is similar to that of lottery winners who win big cash prizes such as the MegaMillions that was up to a billion dollars earlier and now is at 190M. Nearly a third of lottery winners go broke, according to the Certified Financial Planner Board of Standards.

One major problem is simply spending too much. People who have a sudden influx of cash are often surprised to see how quickly it disappears. Many of the athletes who lost their fortunes spent lavishly on jewelry, cars, houses and more.

It’s also common for them to shower others with gifts. If you suddenly find yourself with considerable wealth, distant relatives, old friends, non-profits and others seem to come out of the woodwork to get a slice. While helping out others is admirable, it’s essential to make sure you can afford it first.

Investing money wisely is a key way that athletes can ensure they’re financially comfortable after retirement. Some athletes have given their trust, though, to financial advisors who cheated them out of money or were incompetent. Terrell Owens has said one of his biggest mistakes was trusting advisors and failing to keep an eye on his finances himself.

They may also fall for bad investments and business decisions. Robert Allen Stanford is currently in jail for running a $7 billion Ponzi scheme whose victims included pro baseball players.

Tips for Not Losing It All

Athletes are at a high risk for financial troubles post-retirement because they earn a large amount in a small period and then need to manage that money for the rest of their lives. Many also lack basic financial knowledge.

If you happen to come into a large sum of cash, like pro athletes do, you should educate yourself about financial matters before you start spending. Work with reputable financial advisors but also keep an eye on your money yourself. And in general, saving is better than spending.